You can find hundreds of web-based financial and retirement calculators by doing a simple Google search. Most of them are very basic, inaccurate, and downright dangerous. Why dangerous? Because they can lead people to make decisions based on incorrect data. Imagine a free calculator telling you that you will never run out of money, but all of a sudden you are 72 and only have $1,000 left. This is a nightmare scenario and it can happen if you don’t use accurate planning software.

Table of Contents

There Is A Role For Free Calculators:

Although pretty much every free retirement calculator out there gives inaccurate results, it doesn’t mean they’re worthless. These calculators take lots and lots of shortcuts, which means the results you see won’t be accurate. It’s garbage in, garbage out. If the retirement calculator doesn’t handle items like taxes, social security, Required Minimum Distributions (RMDs), and a whole host of other variables correctly, then the result numbers simply won’t be accurate.

However, if we look at a free calculator as simply a starting point in our journey, then they might be worth something. For example, let’s say you use an online calculator that tells you that you will run out of money at age 65. Well, you should be concerned about this. But that just means it’s time to get a more accurate picture.

Accurate Retirement Planning Using a Financial Planner:

One way to get an accurate picture of your retirement situation is to hire a financial planner. If you do this, you want to use a planner that isn’t trying to put you into high-fee funds or annuities. Hire a planner that that is a Registered Investment Advisor (RIA), which means he or she is legally bound to have your best interests at heart. They won’t try to sell you any products that will only drain your bank account.

Also, look for a planner that is a Chartered Financial Analyst (CFP) or a Chartered Financial Analyst (CFA). These are the only two designations for financial advisors and planners that are worth anything. The other designations (and there are many) are not worth much as anybody can get them in a day or two.

Accurate Retirement Planning Using Online Retirement Software:

If you are a do-it-yourself type, there is good news. With the way technology has evolved, there are now options to find accurate web-based retirement software that you can use on your own. Not only will you save a lot of money, but you will have your plan at your fingertips at all times. No more calling up your financial advisor or planner and asking them to please run a scenario for you. You can now do this yourself any time you wish.

The most popular retirement planning software for consumers on the market today is WealthTrace. WealthTrace has all of the accuracy of software made for professional financial planners, but has an interface designed to make it easy for consumers to use.

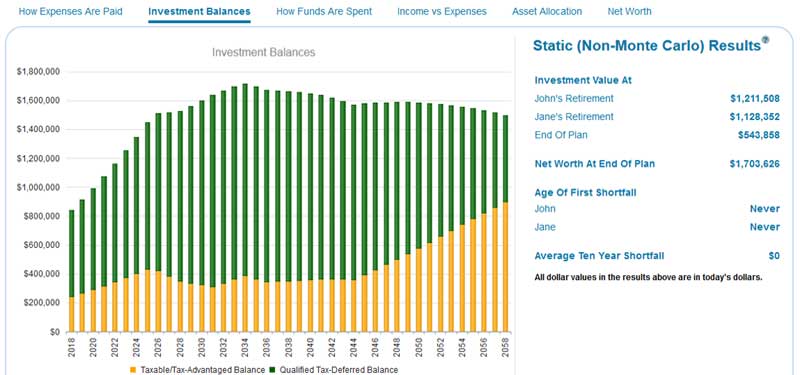

As you can see in the image above, WealthTrace shows you how much money you are projected to have at retirement and at the end of the life expectancy of the person or people in the plan. But there is much more, such as Monte Carlo, which tells you the probability of never running of money.

Monte Carlo analysis uses the historical annual returns, volatilities, and correlations among the assets that you own. Then the analysis runs many simulations and finds those where you never run out of money. This number divided by the number of simulations gives you the probability of never running out of money. This is the same idea used in weather forecasts where we see the percent chance of rain on a given day.

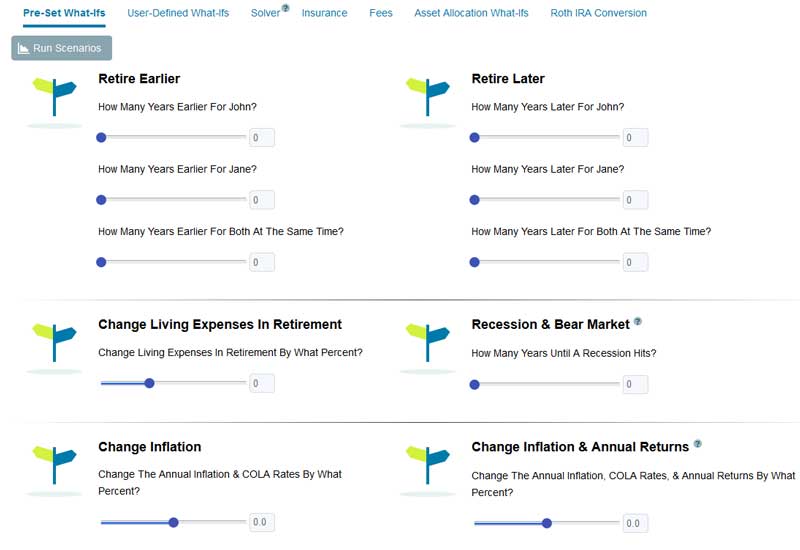

It is also great to be able to easily run what-if scenarios. For example, what happens if I retire two years later? What if inflation is higher than I expect? What if there is another bad recession? What do I need to do to retire when I’m 61? You can easily run these types of scenarios as well.

Seeing Your Financial Picture Daily:

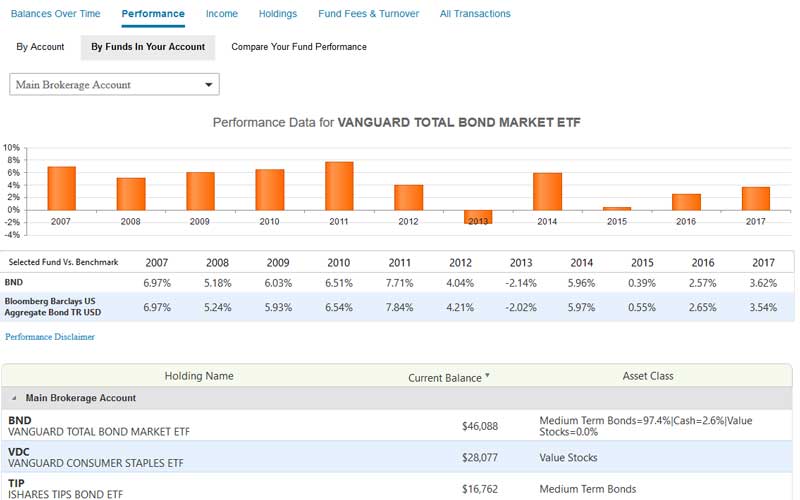

Accurate retirement planning is a very important start in terms of wrapping your arms around your entire financial picture. But it’s also important to be able to check your asset allocation, your performance history, historical transactions, and the fees you are paying. You can do all of this in WealthTrace as well.

You can import and link all of your investment assets, which allows the software to look up historical information on your accounts. The information updates daily, which means each day you can views how your balances have changed and what your overall asset allocation is. The software even allows you to search for mutual funds and ETFs that have lower fees than the funds you currently own. By finding funds with lower fees, you can save potentially thousands of dollars over time.

Don’t Wait to Start Planning:

It is wise to start your financial and retirement planning sooner rather than later. This way you can figure out how much you should be saving in order to retire when you want. You can also calculate a more accurate date when you can retire comfortably. There are good tools out there today that did not exist ten years ago.

Ten years ago most of us were at the mercy of bad online calculators and financial planners or advisors who would print out a large retirement report, hand it to us, and then never see us again. But those days are coming to a close and those of us who want to be empowered with our financial and retirement planning now have the ability to do it ourselves.

Be the first to write a comment.