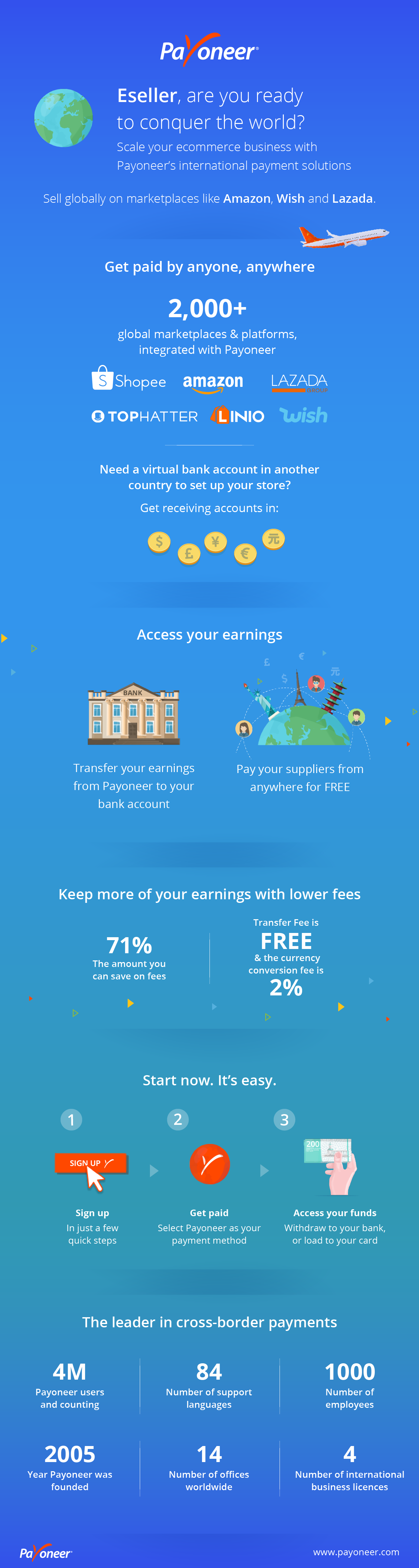

If any Pakistani want to work online then the biggest problem stand in front of them is the payment procedure as world mostly accept PayPal but officially PayPal is not accepting Pakistan so this cause the Pakistani to stay back but now Payoneer is here, The most awaited payment solution for Pakistanis. Now you can do anything online like to start with some Affiliate networks and contracts from all around the world, and also can pay to anyone all around the world and can shop e-commerce sites..!!!

Payoneer offers an incredible payment solution for those who receive money from Payoneer affiliates. Payoneer in Pakistan is a particularly beneficial option since the world’s most popular payment option Paypal is not generally available in Pakistan. However, for those who are using Payoneer for the first time, it can be fairly confusing at first. This article will discuss everything you need to know regarding how to use Payoneer in Pakistan.

Table of Contents

What Is Payoneer?

Avid followers of this blog, if there are any, will already know that Payoneer is a payment solution company that issues payment solutions to freelancers and other people receiving income from foreign countries. Payoneer can be used in Pakistan. How it works is that you receive money through a number of Payoneer partners (including Freelancer.com, oDesk.com, Elance.com etc). If you are creating account from our links so then Once the min $100 money is loaded onto your account, You will get free $25 too. There are NO ACTIVATION FEES if you register through the link below. You can use the Payoneer to get a BANK ACCOUNT IN AMERICA. This can be used to verify a Paypal account and USE PAYPAL IN PAKISTAN!

Advantages Of Payoneer In Pakistan:

Since Paypal is not available in Pakistan, Payoneer remains the most reliable way to receive money from clients abroad. Although at times you may feel like the fees are high, you are guaranteed on-time money (within 2 hours of loading if urgent load option is selected). You can withdraw money from select ATMs across Pakistan, or use the money at POS terminals at petrol pumps, shops, restaurants and other vendors. If you decide to go for Payoneer, you don’t have to rely on local banks, which have a habit of charging hidden fees.

In start, Payoneer now allows users to obtain cards though its website without any partners. If applicants request the card through an affiliate, not only is their application expedited, but they also get $25 FREE once they load their card with $100. But now you can go for direct too but in that case you can miss your $25 so Best of luck for those who goes for Payoneer under referral.

Payoneer gives Pakistanis the option of receiving money through a card in Pakistan. The way it works is simply that you can order a card through the links placed on this page. Once you have received and activated the card, you can receive payments from any Payoneer partner. You can then withdraw this money in Pakistani rupees by inserting your Card into select ATM machines in Pakistan.

Although the card does allow private loads, you need to receive your first payment from a Payoneer Partner. There are hundreds of Payoneer partners, including major freelance marketplaces such as oDesk and Freelancer. After receiving at least one payment from a partner, you can also directly load your card yourself or ask your clients to load it directly through load.payoneer.com.

From Where You Can WithDraw You Money In Pakistan?

You can only withdraw money from select ATMs in Pakistan with the MasterCard logo. All Muslim Commercial Bank (MCB), Standard Chartered Bank (SCB) and Citibank ATMs accept the Payoneer in Pakistan. ATM machines that used to belong to RBS also accept Payoneer .

IMPORTANT: Things To Know:

Monthly cost is normally $3.00 (1-2 transactions) and $1.00 (3+ transactions). Each time you withdraw money from a Pakistani ATM, it will charge you a flat fee of $2.15 per transaction plus 3% of the amount you are withdrawing. If you accidentally try withdrawing more money than you have, it will charge you $0.90 as a failed transaction cost. These costs are fixed for most Payoneer Partners.

How To Use Payoneer In Pakistani ATMs?

1-) Try to find ATM machines of SCB, MCB or other International Banks.

2-) Try to find Main Branches of these banks in your City/Area.

3-) Don’t insert your Card in those ATM machines which are not supporting Card.

4-) Before go to withdrawal from ATM machines .. Make sure you have correct ATM Pin Code..

5-) After insertion your Card in ATM machine which support Card, You been asked to enter Pin Code.

6-) After Pin Code, you have to choose “Credit” from the list of “type of account”.

7-) Try to withraw your cash in multiples of PKR 1,000/- (don’t use 1500, 2500, 10,500 etc…)

😎 Minimum Limit is PKR 1,000 & Maximam limit is PKR 20,000/-.

- Never check your balance from the ATM because they will deduct $0.90 Login to your account on www.payoneer.com to check your balance in USD.

- Some partners only allow you to use their card to receive payments from them (such as Elance). However, most partners will send funds to a Payoneer card that was not issued by them.

How To Load Money From Pakistan In Your Card?

With a card, you can receive payments from clients all over the world through load.payoneer.com . You can also load your card using any Pakistani credit card or debit card, and then use the card to make purchase transactions all over the world.

Payoneer Fees Schedule:

The fee schedule for the card is as follows:

- $24.99 – one time card activation fee.(some Payoneer partners are charging the regular fee of $9.99 for Pakistani clients now)

- $12.95 – Per card One time when issuing a replacement card.

- slow load fee (different for every partner. Many partners have subsidized this fee completely)

- instant load fee (different for every partner)

- $2.15 – ATM machine withdrawal fee per transaction

- *$1.00 – ATM machine balance inquirey

- $1.00 Per Trx When withdrawal request is declined.

- $1-#3 – Payoneer monthly fee (depending on number of transactions made in the previous month)

- **3%* – Currency Exchange fee

* Not available in Pakistan. Balance can be checked on the internet by logging into your account.

** When a transaction is made as a foreign transaction or is requested in a currency other than USD, charges of up to 3% may be assessed above all charges assessed by MasterCard for the transaction.

WARNING: Fees can be change so confirm from Payoneer staff before taking any decision.

DISCLAIMER: Withdrawing more money than you have on your account can result in your card being eaten by the machine. Make sure you calculate a modest exchange rate, taking into account all fees etc. Failed transactions due to insufficient balance are also charged a small fee.

What To Do After Receiving My Card?

Did you FINALLY just receive your Payoneer MasterCard in the mail? Once you are done with the initial excitement of owning a card, run through the following guide to make sure you know exactly how to use the card in Pakistan.

Step 1: Open the envelope.

- Rip open the envelope you have received from Payoneer

- Unpack the card

- Switch on your personal computer

Step 2: Activate your card.

- Go to www.payoneer.com

- Click on Activate your card in the panel on the right

- Enter your account details to login to your Payoneer online account (these are the same details you chose when you ordered the card). The username is your email address.

- Once you login, you will see a button you can click to activate your card. Click it!

- Enter the 16 digit card number located on your card, and choose a 4 digit pin number.

- Celebrate the activation of your card!

Step 3:Use your card.

- Your Payoneer card can be used in thousands of locations across Pakistan

- You can withdraw money from selected ATM machines all over Pakistan. Your card will only work at ATM machines that support MasterCard. In Pakistan, these include MUSLIM COMMERCIAL BANK, CITIBANK and FAYSAL BANK.

- You can see a list of ATMs near you that support MasterCard by visiting the link below.

- Make sure you look out for the MasterCard logo on the machine before you insert your card

- Remember that Payoneer’s daily spending limit varies depending on which vendor you got your card through. Odesk cards have a daily ATM withdrawal limit of $2,500 but this does NOT mean you can withdraw this amount. Local ATM machines have varying daily withdrawal limits. Consult the bank associated with any ATM machine you are withdrawing from before making large transactions.

- Remember that all transactions in Pakistani ATM machines are done in Pakistani Rupees.

- Remember not to check your balance from the machine, but to check it online. Most machines in Pakistan do not support checking of balance of MasterCard cards, and your card could get eaten up.

- You can also use your Payoneer MasterCard debit card at any shop, petrol pump or restaurant that accepts MasterCard payments. All big stores etc accept this method of payment.

Last Words:

So this is the Payoneer that helped Pakistanis to earn from thee land so now its upto you to keep Payonner safe from black listed peoples. Do everything in legal way. Promote it and help others.

Be the first to write a comment.