KYC verification is necessary for businesses across the world. Organizations use modern technologies to verify the identity of customers to prevent fraud and scams. Using digital ways of verification allows firms to take a step ahead in ensuring the client’s identity. The traditional ways of verifying a person’s identity are being replaced by new, more intelligent, and faster methods. This blog will discuss the importance of digital KYC in the modern world and will compare the differences between traditional verification methods and today’s improved and advanced KYC solutions. But before that, let’s discuss what digital KYC is and how it differs from traditional verification methods.

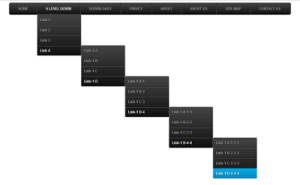

Table of Contents

What Is Digital KYC?

Digital KYC is the process of verifying customer identities using innovative methods and modern technologies such as artificial intelligence and machine learning. It is much faster when it comes to processing user data and also operates more accurately. As online platforms are increasing at a great pace, businesses must adopt digital KYC solutions to make sure that their business is in line with market trends. Digital KYC involves different methods and techniques to verify a customer’s identity.

Digital KYC Vs Traditional KYC:

Digital KYC is fast and operates via online means while traditional KYC is much slower and works on old paper-based manual methods. The Digital KYC process ensures high accuracy while there are many chances of errors using the traditional means of verification. When it comes to onboarding, digital KYC allows businesses to hire new clients from anywhere in the world without physically needing to be present at the location. In traditional KYC verification, onboarding new clients from remote places is impossible.

Digital KYC Verification Methods:

Digital KYC onboarding is performed using various methods that ensure complete verification of the customers. After the introduction of AI in modern-day operations, identity verification is taking new turns, solidifying security across systems worldwide. Here are some of the most used digital KYC solutions.

Document Verification:

Document verification is a critical component of the digital KYC process, allowing businesses to confirm their clients’ identities by scrutinizing important papers such as government-issued IDs, passports, and utility bills. Document verification has become more efficient and accurate due to technological improvements, lowering the danger of identity theft and fraud. Automated systems employing Optical Character Recognition (OCR) may quickly extract information from submitted documents, cross-referencing it with databases and records, giving enterprises a dependable and smooth way of authenticating customer identities without sacrificing security.

Biometric Verification:

Biometric verification elevates digital KYC by utilizing individuals’ unique physical characteristics, such as fingerprints, facial features, or iris patterns, to validate their identities. Because biometric qualities are highly distinctive and nearly impossible to copy, this image-based KYC provides an extra layer of security. Biometric verification not only improves the customer experience by simplifying the identification process, but it also protects against impersonation and identity fraud, making it a useful tool for organizations in a variety of industries.

Address Verification:

Businesses must ensure the accuracy of customer addresses in order to establish a trustworthy connection with their customers and comply with regulatory standards. In digital KYC, address verification entails cross-referencing the submitted address with trusted databases and external sources to ensure its validity. Businesses can verify that the address belongs to the individual seeking their services by correlating this information, enhancing transparency and lowering the danger of fraudulent operations.

2-Factor Authorisation:

2-Factor Authorization (2FA) greatly increases the digital KYC process by adding an extra degree of protection. 2FA ensures that only authorized individuals can access sensitive information by requiring users to provide two independent pieces of identity, such as a password and a One-Time Passcode (OTP) sent to their registered mobile device. This extra layer of security improves data security, minimizes the likelihood of unwanted access, and gives customers more confidence when making transactions or accessing online services.

Video KYC:

Video KYC is a new and user-friendly approach for bringing digital KYC to a more intimate level. Businesses may guarantee the authenticity of the individuals they are onboarding by allowing consumers to connect with KYC staff via live video calls. Video KYC provides real-time face-to-face verification, lowering the risk of identity fraud while providing a smooth and convenient customer experience. This method also makes verifying papers and biometric data easier, increasing trust between corporations and their customers.

Conclusion:

Digital KYC verification solutions have developed as vital tools for enterprises across numerous sectors in the digital world when client data protection and regulatory compliance are paramount. Document verification, biometric verification, address verification, 2-factor Authorization, and video KYC are changing the way businesses onboard clients and build trust. These innovative solutions improve security, speed up the client onboarding process, and reduce the dangers of identity theft and fraud.

About the Author:

About the Author:

Be the first to write a comment.